Supporting all types of financial institutions - Credit Unions, Banks, Mortgage Companies, Consumer and Auto Lenders, Fintechs, Depositories and Asset Managers, Legal Advisors and more.

Support and streamline cleanup for multiple data types and submission workflows for CRA and HMDA. Produce powerful, real-time, out-of-the-box analyses and reports.

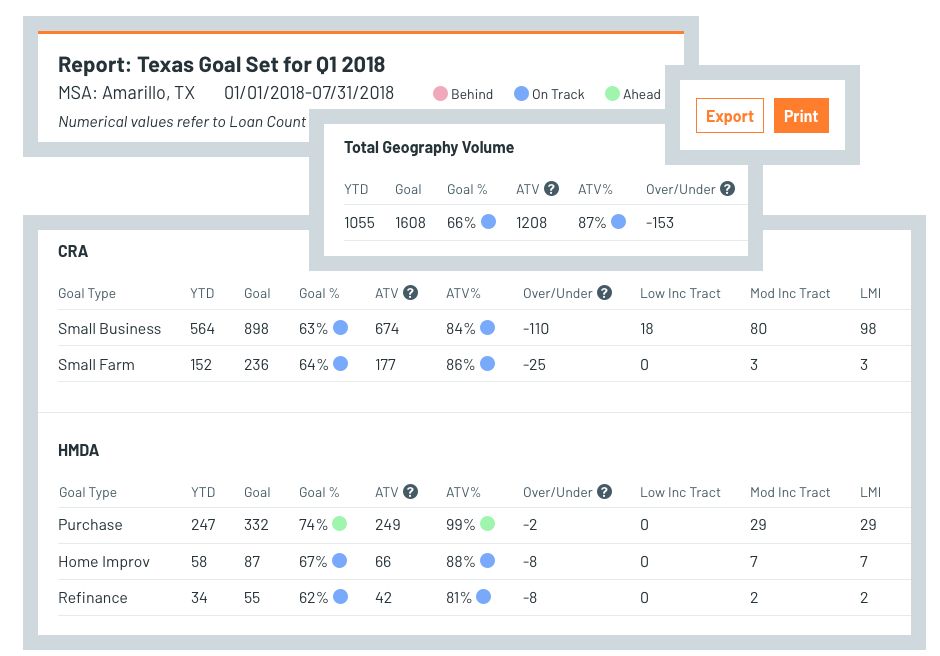

Focus on proactive measures and strategic planning to meet your institution’s lending goals.

Lenders today use their own templates or develop custom dashboards to generate performance reports for management to monitor progress against internal goals. Manually pulling out information from multiple reports and plotting them into these unique formats can be time-consuming, inefficient, and costly.

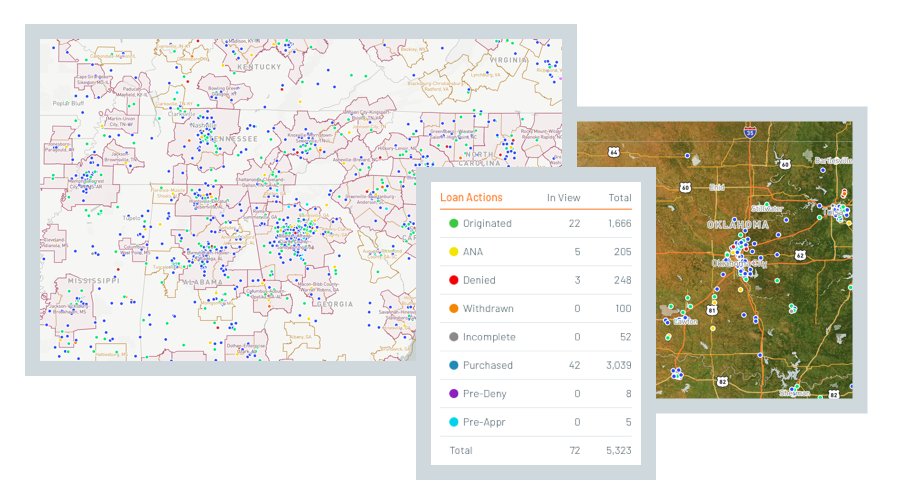

RiskExec’s interactive mapping experience and multi-layered geocoding capabilities deliver more complete and accurate results than the competition in an intuitive user experience.

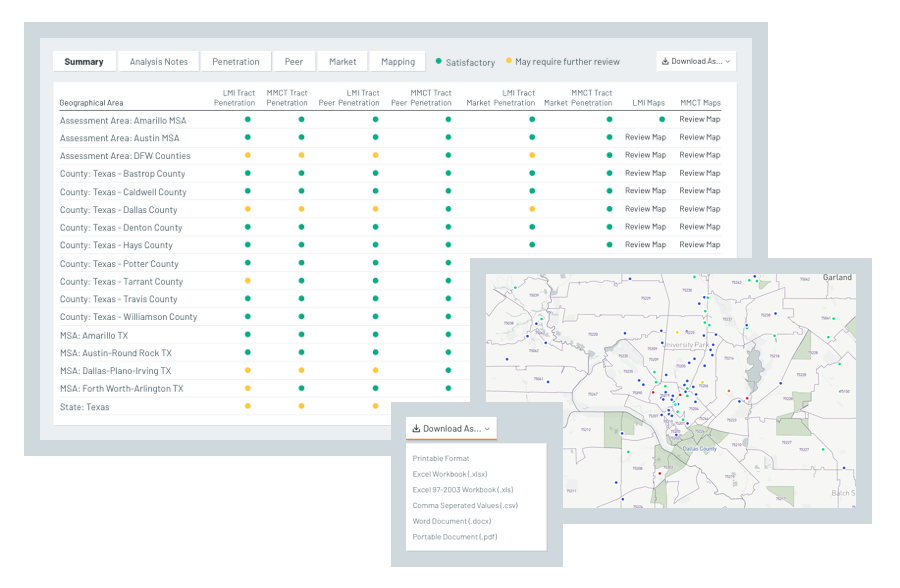

RiskExec is the only compliance solution offering a dedicated redlining analysis tool that streamlines the review process to help identify in-scope geographies, select peers, generate relevant analytics, and concisely display results.

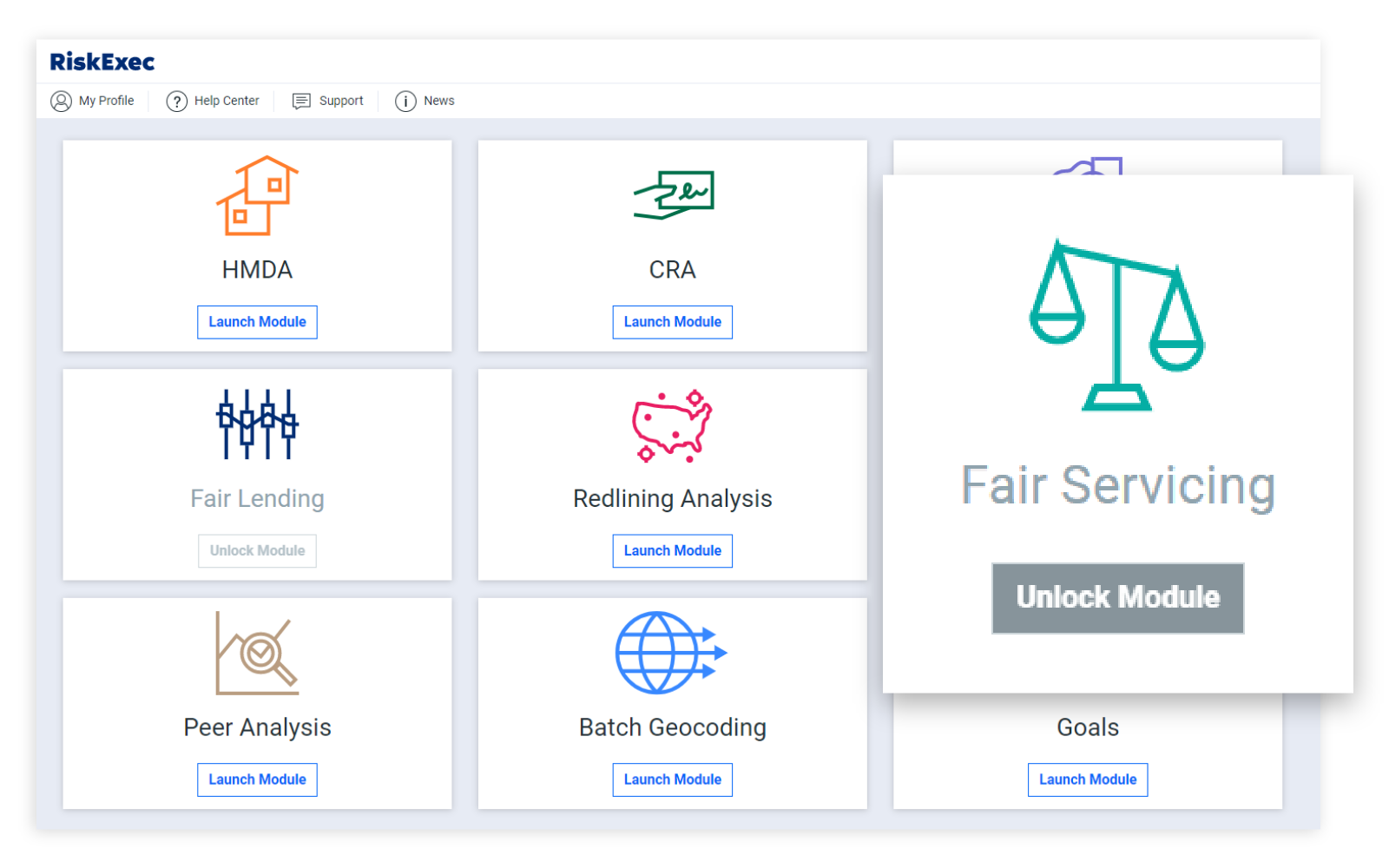

RiskExec, the industry’s leading Fair Lending analytics software provider, offers a powerful Fair Servicing analytics module that gives servicers the tools and statistical analyses needed to proactively uncover potential risks in handling forbearance requests, terminations, and loan modifications.

See how RiskExec’s Fair Servicing analytics module can help you transform your data into valuable fair servicing insights, all from one easy-to-access dashboard.

Prepare your 1071 data with ease and submit with confidence utilizing RiskExec - our flexible, intuitive compliance and analytics 1071 small business lending compliance software. Or, let our team of nationally recognized compliance domain experts help you prepare.

Data can be misused to present unfair claims-forcing costly litigation defense, and/or settlements and cause significant harm to your institution’s reputation. Get ahead of it with RiskExec.

RiskExec is an essential tool for our compliance with CRA and Fair Lending regulations – from data scrubs, geocoding, and mapping, to reporting, redlining and fair lending, we love all that RiskExec has to offer. We have found the support from RiskExec to be prompt and professional and the continued enhancements to the solution are extremely relevant and keep up with regulatory and industry trends.

RiskExec is a great tool to support and enhance our compliance and regulatory efforts. It has helped us to automate manual tasks and processes to increase efficiency and improve the quality of our data analysis. The implementation process was smooth, the tool requires limited IT resources, and we consistently receive outstanding client support.

The HMDA filing process through RiskExec went very smoothly. All the items on the FFIEC filing website matched RiskExec’s final results exactly to the letter. I especially appreciate the two checks your team performed and the tutorial video you did detailing the entire filing process. Thanks so much for all your help.

We have been with RiskExec for seven months now, and our only regret is that we did not find them sooner. The solution is highly customizable to our needs, and every support request is fielded by persons with top-shelf understanding of regulation, and what we are trying to achieve. I have no hesitation about recommending RiskExec to my peers.

The functionality of RiskExec has enabled my company to utilize a high-performing, low cost solution to an intricate problem. I receive friendly, immediate support from the staff, multiple data reports make analysis easy and coherent, and the mapping features have made the software applications cross-departmental between lending and marketing. It is a wonderful tool that makes HMDA much easier to tackle.

After 8+ years of using the RiskExec software, the reliability and the technical support continue to be top-notch. Thank you for consistently providing outstanding service.

The entire RiskExec process is seamless; I couldn’t have asked for a better experience! Beverly’s guidance and assistance, including calling us from the road on her way home last Friday evening to make sure we were able to submit, was going above and beyond the call of duty. She called us this morning as a courtesy to simply follow-up and make sure we’d gotten our response letter back indicating successful submission. I just wanted you to know how much we appreciate this level of support, especially with our first CRA submission, which appears to have gone through swimmingly! Thanks again!